Net profit = revenue - all expenses, including tax and interest.This figure includes fixed costs but excludes tax, interest payments on debt and income from investments that are outside the realm of the core business.

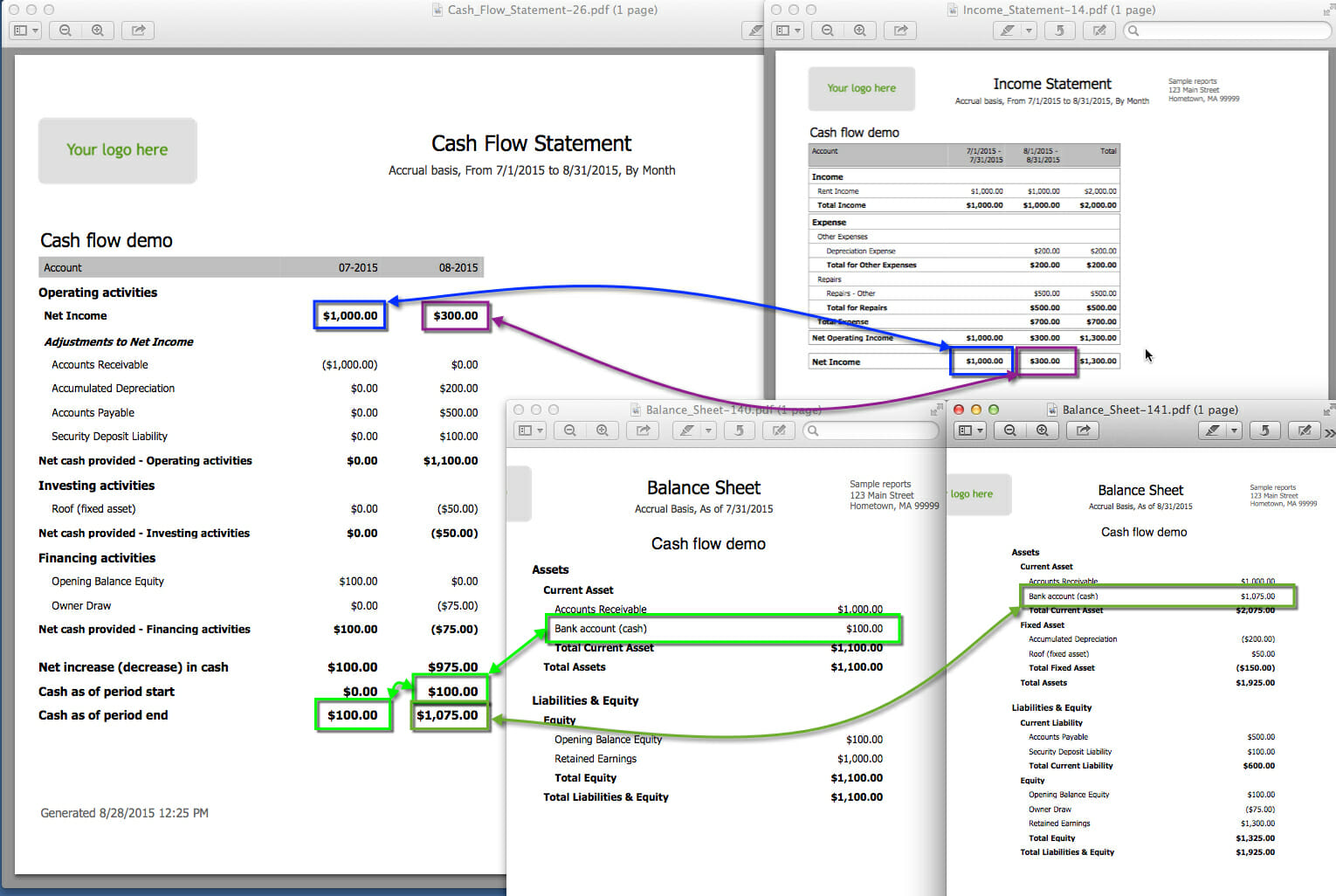

In a nutshell, profit = revenue - expenses. However, a sustained period of negative cash flow means that your business is running out of fuel, and you need to take action. It’s normal to experience a short period of negative cash flow when you are investing in growth, since you must first spend money in order to generate more liquid assets in the future. Positive cash flow means that more cash is coming in than going out, and thus your business’ liquid assets are increasing. Financing cash flow: the net cash generated to finance the company, including debt and dividend payments.During a period when your business is actively investing, this number may be in the negative but it will become positive when these investments begin to generate a return. Investing cash flow: cash earned from investments, such as securities, property or the sale of assets.Operating cash flow: the amount of cash generated from regular business operations, such as sales.If your business is a car, then cash flow is the petrol in the tank - you can’t move forward without it.

A business needs cash in order to continue operations without it, the owner cannot pay suppliers, staff and utility bills, or purchase inventory. It refers to available funds rather than money tied up in uncollected profits or hard assets. In the long term, a business needs both positive cash flow and profits to continue operation, but which one should entrepreneurs be prioritising? Some say that “cash is king” whilst others argue that “profit is everything,” but what is the truth? Let’s take a closer look and find out.Ĭash flow is the money flowing in and out of a business. It’s the age-old debate: cash flow or profit? Whilst the two are undoubtedly related, they are certainly not the same thing and business owners must often sacrifice one at the expense of the other.

0 kommentar(er)

0 kommentar(er)